Keynote Talk: Traceability in eCommerce

Robert Bodemuller

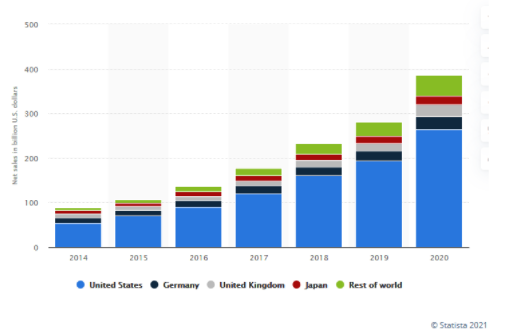

Abstract: It is estimated that there will be 2.14 billion global digital buyers in 2021 or about 27.2 percent of the world’s population shopping online. Sales are expected to account for 18.1 percent of retail sales worldwide in 2021, up from 14.3% of total retail sales in 2018, 12.9% in 2017 and 11.6% in 2016. The ecommerce industry is projected to grow to $600 Billion by 2024. The pandemic has accelerated the move from “box stores” to online markets. While most to the sales are in the retail area the question arises of how does this affect industry?

When going online to look for a retail product what is the first-place people think of? Amazon.com Inc is number 1 in the United States. Amazon delivered a record performance in 2020 with annual revenue up 38% to $386 billion, a yearly increase of over $100 billion. The trajectory of Amazon’s growth will accelerate as the company continues to control more of the supply chain and masters last-mile delivery.

As Amazon continues to be successful more companies are rapidly expanding their online presence. What does this mean to the supply chain and buying habits at a manufacturer who faces cost, availability and delivery pressures on a daily basis? An increase in counterfeit products along with increasing cybersecurity risks have resulted as ecommerce has facilitated and increased the ease of penetrating the normal supply chain with counterfeit products using various business models. This study examined a small part of the supply chain for items that are essential for a business to operate a resulted in two case studies to illustrate the differences in the business models and the risks that result. The study looked at IT peripherals equipment to see where these items come from, what is the path they follow to the ecommerce platform and who makes the products. These items have considerable cyber risks as points of penetration into a company’s infrastructure and systems as well as providing less reliable products that can have a negative effect on productivity. The second scenario was a look at the ease of buying EEE parts that are in current production but a small business, i.e. the 2nd or 3rd tier, because there are minimum buy requirements. Both cases represent real life instances.

The third scenario looks at a common retail item and tracks the material from the marketing firm selling the part to determine the most likely place the materials were manufactured. In between the two is the trademark holder, the corporate identity of the marketing company, the company's real name, and where they are incorporated. Again, the trail illustrates that the true supply chain may not be what it seems on the surface.

In this presentation I will track backward to answer the question … Where do these parts come from and identify some of the potential counterfeit and cyber risks.

Bio: Bob Bodemuller is a principal engineer at Lockheed Missiles and & Fire Control (MFC) in Grand Prairie, Texas, in supply chain quality, where he is the subject matter expert (SME) in counterfeit part avoidance and risk mitigation and a Distinguished Member of the MFC Quality and Mission Success Technical Excellence Staff. Bob joined the SAE G-19 committees in mid-2000, where he participated with the development AS5553 and has worked on other SAE counterfeit mitigation committees, including G-21, G-19C, and G-19D. He currently serves as the Chairman of the Counterfeit Avoidance Accreditation Management Council.

Bio: Bob Bodemuller is a principal engineer at Lockheed Missiles and & Fire Control (MFC) in Grand Prairie, Texas, in supply chain quality, where he is the subject matter expert (SME) in counterfeit part avoidance and risk mitigation and a Distinguished Member of the MFC Quality and Mission Success Technical Excellence Staff. Bob joined the SAE G-19 committees in mid-2000, where he participated with the development AS5553 and has worked on other SAE counterfeit mitigation committees, including G-21, G-19C, and G-19D. He currently serves as the Chairman of the Counterfeit Avoidance Accreditation Management Council.

Bob has worked with industry as a member of the AIA Counterfeit Avoidance Working Group on counterfeit issues in the legislative area and has provided input during the public comment periods to DOD on the newly drafted DFARS.

Counterfeit Symposium 2021Register NowTop